Many seniors and baby boomers today are renting in retirement versus owning their homes, according to a recent article from USAToday, Should you own a home in retirement? Maybe Not.

Usually, the biggest factor that impacts this decision is cost. A house may seem like the ideal place to live out your retirement until bills start piling on, or tasks you’re no longer physically able to do, like taking care of your lawn or house cleaning. If you own an older home, you may have extensive updates that could increase more costs.

If you’re on the fence about renting versus owning, here are some other considerations that may help.

Preparedness for future living changes

According to the Center for Retirement Research at Boston College, 44 percent of men and 58 percent of women will need nursing home care after turning 65. Life can throw unexpected curveballs, even if you currently feel healthy. Your once manageable home could become quite uncomfortable as you age and may be a burden to own later on. Renting offers the flexibility of adjusting your care needs as they change.

Access to programming

Senior living communities like The Kenwood offer numerous programs you won’t find anywhere else. These programs, like laughter yoga, bridge class and art club, build cognitive and physical mobility. Plus, you get the added benefit of meeting other seniors. You can always find an activity you love when a community offers multiple levels of care.

Socialization opportunities

Loneliness is a big problem among seniors and more than 40 percent of seniors experience it. Seniors who live at home alone are more prone to this issue, which is why senior living communities are ideal to fend off the problem. You can always find a friendly face, whether from fellow seniors or staff at the community.

Tap into home equity

For many people, a home is one of the biggest investments you can make. If you’re considering your senior living options, why not use your home as a retirement asset? Retirees can take advantage of it by downsizing, taking out a home equity or considering a reverse mortgage.

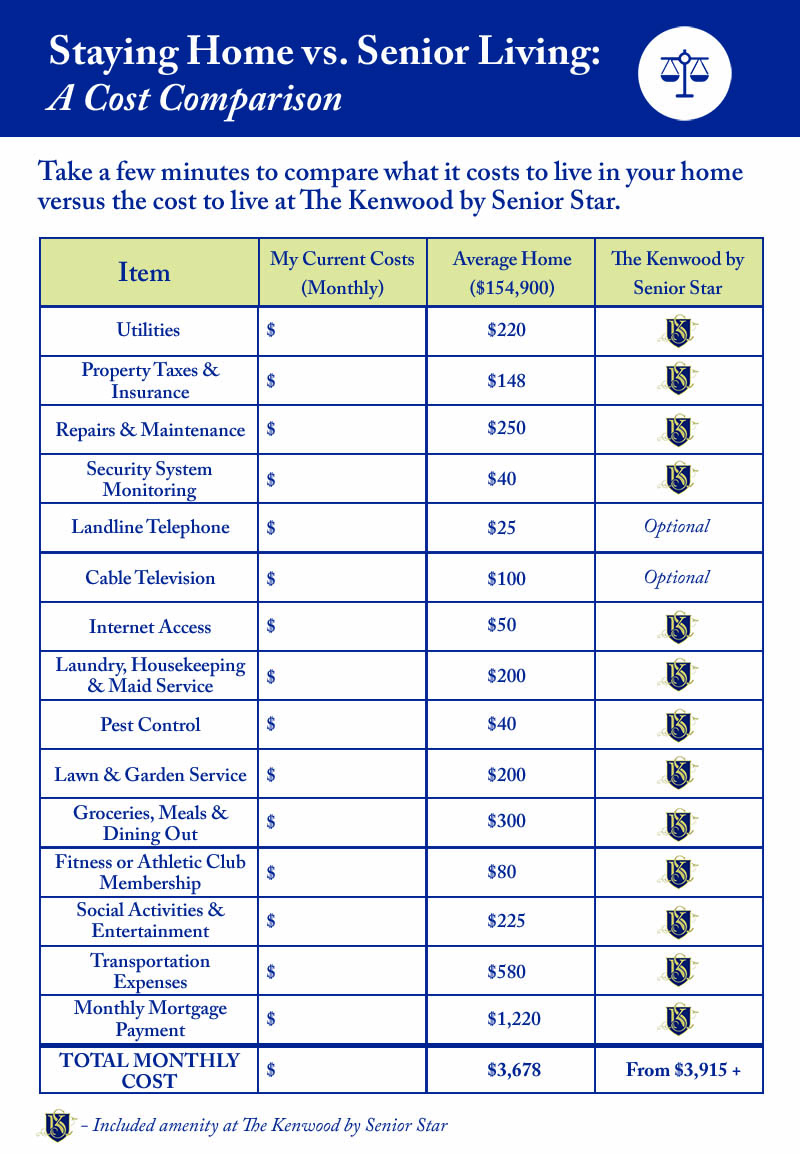

Understanding your senior living needs will help you prepare for the best retirement. Download our Financial Guide to Senior Living for helpful resources and information about the cost of senior living – or use our comparison tool below to determine what it costs to live in your home versus living at The Kenwood by Senior Star.